Shifting Manufacturing and Supply Chain Operations to Mexico

Shifting Manufacturing and Supply Chain Operations to Mexico

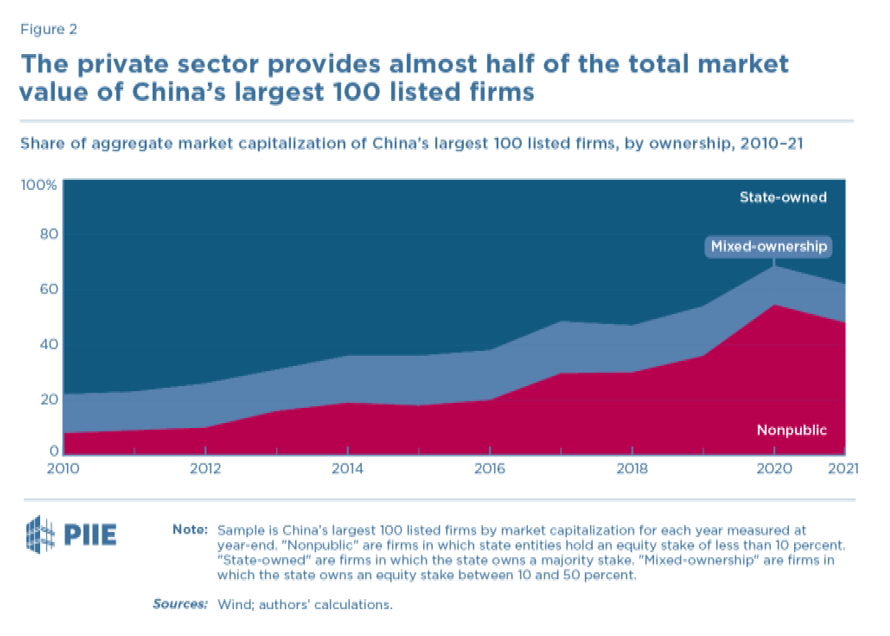

Companies have been sourcing and manufacturing in China for many years and enjoyed low labor rates, reasonable logistical costs, and a large supply chain base. However, the economic business model has changed as companies are looking to “localize” their supply chain and manufacturing closer to their customer base.

companies servicing US and North American customers are actively working to establish supply chain and manufacturing in Mexico to diversify beyond China.

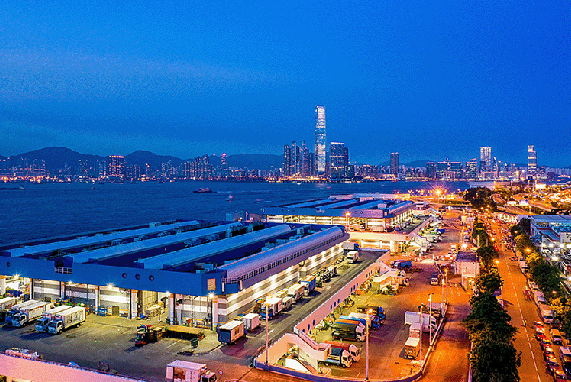

The trend to diversify beyond China has been caused by a lot of issues, including significant logistical increases, expanding transit lead times, US/China tariffs, increasing Chinese production costs, Covid travel restrictions, etc.

As a result, for companies servicing US and North American customers, they are actively working to establish supply chain and manufacturing in Mexico to diversify beyond China.

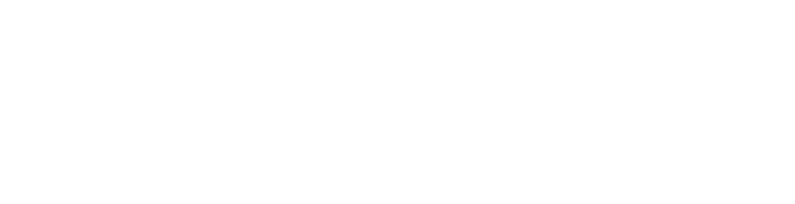

For companies that serve Southeast Asian and even Chinese customers, we have seen a similar diversification trend from China to Vietnam and Thailand. Additionally, companies servicing European customers are diversifying to Central Eastern Europe for supply chain and manufacturing, rather than China. We do not expect these trends to slow significantly, even if shipping rates and lead times eventually moderate.

However, Mexico is not always a replacement for China. It does not have the same abundance of suppliers from multiple different industry sectors. Additionally, Mexican suppliers are currently being overwhelmed by the substantial number of requests from US companies looking to diversify beyond China.

In many cases, these suppliers are not responding to the large number of quote requests or are providing expensive quotes to determine if the company is willing to accept.

While Mexico does have good suppliers in specific industries, some components and products from China remain less expensive. Therefore, in our analyses, manufacturers are jointly reviewing the Bills of Materials (BOM) to determine which countries offer the best diversification alternatives, e.g., sourcing some products from Mexico and then, supplementing diversification efforts in Central Eastern Europe and Southeast Asia.

While Mexico has good suppliers in specific industries, some components and products from China remain less expensive.

US Automotive Manufacturer Example

As an example, a U.S. automotive manufacturer asked East West Associates to review their Bills of Materials (BOM). East West evaluated both Mexico-based and Thailand-based automotive suppliers for products shipped to the U.S.

Thailand was a good and less expensive supply chain source for particular automotive parts not currently produced cost-effectively in Mexico.

The company would have a long lead time sourcing from Thailand, as they do sourcing from China. However, they will not be paying applicable US/China Tariffs and are less susceptible to the geopolitical challenges between the US & China.

In this case, the Mexico and Thailand sourcing strategy worked well for the Automotive Manufacturer who need to cost-effectively diversify their supply chain network beyond China.

EAST WEST ASSOCIATES

About our Operations in Mexico

East West Associates seasoned executives are based in China, Southeast Asia, Central Eastern Europe, Mexico and the U.S. We are uniquely qualified to provide pragmatic support to companies that need to diversify their supply chain and manufacturing.

The East West Associates Mexico team has been operating in Mexico for many years and as a result, they provide on-the-ground support In Mexico. They have the existing business relationships to arrange meetings with Mexican companies, obtain qualified requests for quotes, support the product sampling phase, and develop new Mexican suppliers for U.S. manufacturers and distributors.

East West Associates supply chain and manufacturing projects in Mexico include:

-

- Supplier identification and qualification of Mexican suppliers, and generation of RFQs to selected suppliers. Industries include automotive parts, automotive aftermarket products, aluminum extrusion, specialty stainless steel, lead-free brass plumbing fixtures, machines castings, injection molded plastics, steel stampings and medical products.

- Supplier audits of Mexican vendors

- Background Checks of Mexican suppliers

- Cost & Feasibility Analyses of establishing operations in Mexico vs. the U.S.

We are very active in this diversification trend, and have conducted numerous webinars on developing successful Mexican suppliers and manufacturers.

For assistance with determining if Mexico is right for your company or if you have additional questions, please call or contact us at 704.807.9531 or abryant@eastwestassoc.com.

Timely Topics To Drive Growth.

Sign up for our webinars.

Sign Up