Volatility Matters Less Than Risk

Turbulence in global markets has fueled a cottage industry in geostrategic analysis where the dominant narrative concludes that war with China—cold and likely hot—is inevitable and that companies must follow the theory of Gwyneth Paltrow and consciously uncouple.

by Francis Bassolino

Owner, Alaris

Volatility is just a temporary phenomenon (assuming you survive it financially) and investors shouldn’t attach as much importance to it as they seem to. –Howard Marks

Turbulence in global markets has fueled a cottage industry in geostrategic analysis where the dominant narrative concludes that war with China—cold and likely hot—is inevitable and that companies must follow the theory of Gwyneth Paltrow and consciously uncouple. Like anyone who asks Bono about the pathway to world peace, we question the intelligence of the person asking and the ethics of the pundits who talk of things they do not know.

It will pay to keep a few things in mind while scanning the deluge of commentary foretelling China’s future. First, in July 1989, nobody predicted that three years later Deng would declare “To get rich is glorious and poverty is not socialism”.

Second, none of the commentators have shared tea or an unscripted moment with anyone two steps removed from those in power. The new inner circle in Xi’s China is tight and tightlipped. As Laozi taught us, “Those who know, do not speak. Those who speak, do not know”. 知者不言,言者不知.

And third, an open rigorous dialogue with Xi’s inner sanctum would not reveal just how China will navigate the near to mid-term challenges. There are just too many variables. Emerging from Covid will be turbulent and messy.

Notwithstanding these challenges and unknowns, many companies are weighing downside risk more than is warranted. In this piece we consider the risks and probabilities, concluding that the biggest hazard is focusing on defense when the true winners will be the ones who aggressively develop strategies that can capitalize on the most probable outcomes which include growth and a return to practical engagement.

China is not taking over the world

First, let’s consider something that recent history has revealed. China will not dominate the 21st Century. Geographic constraints, ineffective education systems, financial institutions that misallocate capital, and demographic challenges combined with ill-conceived socioeconomic policies stifle the proven path to dominance which is productivity growth. Labor and capital inputs have been generating diminishing returns for some time and the Chinese institutions have been slow to respond to this fundamental reality.

It is increasingly difficult to argue that China is led by omniscient technocrats outsmarting the market. Indeed, the heavy hand of the vision of the anointed have made many choices that hamstring development. Long-time China watchers—even the optimistic pollyannaish ones—bemoan the coming decline, hoping for a shift back to the practical realism and liberalization which has served China so well.

Second, many leaders in China do not aspire to join the liberal world order. For a long time, many Westerners assumed what was tactlessly yet concisely articulated in Full Metal Jacket, that “Inside every gook is an American trying to get out”. This thesis found a more sober rendering in Fukuyama’s The End of History, which postulated that the world had settled on liberal democracy as the optimum and desired operating model. The tiger economies were the poster children for this movement. But alas, engagement has not converted all the heathen and many of those who voted for engagement have now concluded that China is the leading strategic rival. On this Democrats and Republicans agree!

The current Chinese leadership has rejected this liberal world order, preferring homegrown systems and processes to set strategy and maintain stability. Some label China’s systems authoritarian, others benevolent dictatorship. The Chinese tend to refer to it as traditional values or even the Singaporean model which holds appeal for most of the population.

Regardless of the labeling or considering whether it is the right or wrong path, we suggest that those who engage with China need to understand that there is no urgent or inevitable movement to converge with Western thinking on social structures and contracts. And perhaps here another Buddhist acolyte might be worth listening to, “We cannot choose whether to engage with the world, only how to.”

Our Model is Better

A central debate for much of the nineties was “Should China be allowed to join the WTO and if so on what terms?” In the end, China joined under vague conditions which set milestones for continued reform. As China grew stronger, and particularly after 2008, China concluded the West was in decline and that many reforms were optional. China began to espouse a belief summed up as “China has now stood up and we will no longer adhere to the contracts which we signed under distress. We have a better model.” The most ardent spokespeople for this belief system now come to us as wolf warriors, zealous diplomats on a mission to spread the word of China.

This mission posits that China’s development model is more utilitarian and egalitarian than liberal democracy. The model “Benevolent Paternalism”—aka Daddy Knows Best—is an intellectual framework loosely built on an ideological and institutional foundation of Lenin and Confucius, favoring Legalism’s strict rules and decorum over live-and-let-live Buddhist principles which are also still floating around the minds in China. Rather than debate the merits of such a framework, let’s discuss “How does it impact business and what’s next?”

Quantify the Risks and Forge Ahead

For many companies, China’s political philosophy is of little relevance to their bottom line or investment thesis. Indeed, given the fluid unstructured, immature and fragmentated nature of many markets, even near term macroeconomic and sociopolitical trends are second-order priorities. For example, in a rapidly growing market with no clear leader, economic results are driven by more pedestrian issues of leadership, strategy, and execution. Said differently, success or failure boils down to calculating expected outcomes and effectively deploying capital to capture opportunities. And moving fast. Often much faster and in directions that challenge global HQ operating norms and reporting lines.

Naturally it is ridiculous to ignore the macro environment and institutional structures. And everyone wants to know “Is China in decline?” The answer is we don’t know. It is too early to tell. The demographic dividend has switched to a massive burden. And the rigid institutional infrastructures are ill-suited to manage complexities of the size, scale, and dynamism of this current era. The inability to shift away from zero covid is just one very visible and recent manifestation of this challenge. The clumsy mishandling of tech giants another. However, the global consensus on China on a whole host of issues rests on too few data points to proceed with the certainty we see many assume.

For example, the attention-grabbing narrative that Xi is emperor for life ushering in the next cultural revolution is a simplistic unproven hypothesis. Yes, he broke precedent with a third term, but does he fancy himself as Mao or Lee Kuan Yew? Many corrupt officials are still waiting out the anti-corruption drive attached so closely with Xi. And there is a rationale argument to consider that changing captains mid storm is less than ideal. Americans may be loath to recall that the beloved FDR also broke precedent with his third term!

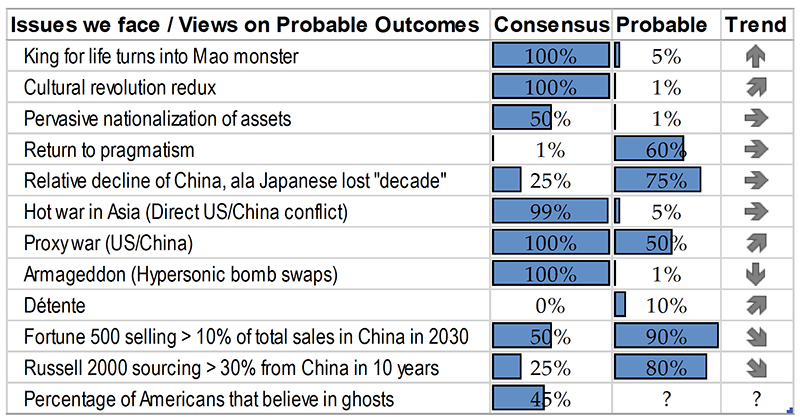

The extension of Xi’s term has set China on a path that is prone to end badly but this is not a foregone conclusion. Only time, and events over the next few years will reveal the trajectory. In an odd way, even after 10 years in power, no one really knows what this dude is thinking and how the CCP will respond to the power Xi has amassed. But as our table below indicates, consensus seems to be the Xi is going to become a monster that leads the next Cultural Revolution. We think that this is a crude argument and unlikely outcome even if this is what Xi wants.

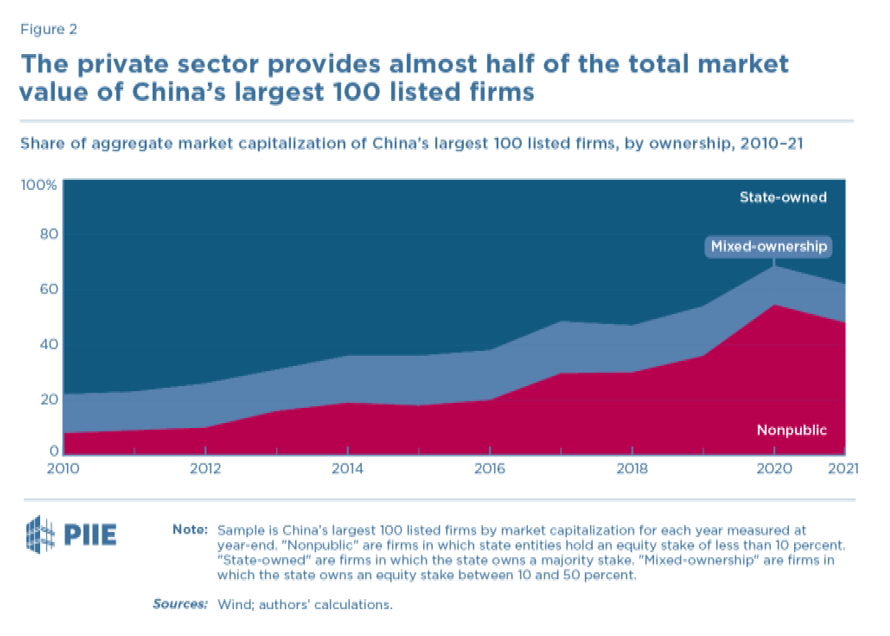

China is not on a path to nationalize assets. Yes, Jack Ma has been knocked off his pedestal as were many entrepreneurs who challenged the state’s monopoly of opinion or industries viewed as central to control, e.g., information, education, entertainment, and finance. But there is a good argument that the current administration has read Rajan and Zingales and they are trying to “Save [Chinese] Capitalism from the Capitalists”. Clearly there is an attempt to concentrate power in state-owned companies, or oligopolists easier to control, but these efforts have not been successful.

Contrary to popular belief, private enterprise is not losing ground to the State. From capital formation to employee headcount, the private sector continues to grow faster than the State. The recent downturn in the economy will have a disproportionate impact on private enterprises, but the longer-term trend seems clear. Over the past decade, employment in the private sector has grown at 10% per annum while State employment shrunk by 2%. Today, about seventy-five percent of employees work in private companies. Killing the private sector would be suicidal as the State continues to generate poor returns. Unemployment plus inflation and stagnation equals revolution with pitchforks.

Three other common misconceptions were outlined in our last piece “Profits of Doom”:

-

- The US and China will not have a hot war over Taiwan because the military risk is just too high. China would probably fail. And even if China wins, they lose.

- Companies will continue to source from China due to deep, dependable, and competitive supply chains, plus the human capital and infrastructure to activate

- Companies will continue to be attracted to the compelling demand opportunities in China. There are 500 million “middle class consumers” with disposable income profiles and market dynamics that offer double digit growth opportunities. Most markets lack category leaders. Therefore, the right product in the right channel can grow exponentially and command outsized profits.

We can’t see the bottom, but we should jump in

In the fog of war it is difficult to predict outcomes. The next twenty-four months will reveal the true intentions of this government and the future of China. What seems obvious at this junction, however, is that China will implement a massive stimulus, the currency will remain “competitive” and, perhaps with a little luck, the US and China will find some path to détente—or at least rational civility as was on display at the G20 in Bali.

Avoid the fallacy of incredulity, the belief that because something is difficult to understand, it is false. We are dealing with an ambiguous situation and lack of information. Rather than fall for the illusion of validity, concluding China is the antichrist, we encourage fact-based scenario planning. In our estimate the most probable scenario is that China will return to the table as a practical partner because the other paths are dead ends. Use this as a strawman.

The West cannot dictate the terms of engagement demanding that China institute political pluralism, particularly when its own house is in such disarray. China has a system that has delivered impressive returns. It would fail miserably in the US and frankly if history is repeated, “common prosperity” will create “common poverty” and peasant rebellion. But prepare for the converse. China will be a viable and valuable market in 2-5 years. And odds are that China will surprise on the upside at least in the medium term. The biggest risk for most companies is not being in the water when the wave comes. Stop talking about Taiwan and add that thought for more positive outcomes to the boardroom agenda.

Is your aversion to volatility financial or emotional? –Warren Buffet

Francis Bassolino runs Alaris, an investment and advisory firm. Francis_bassolino@alaris.com.cn

Timely Topics To Drive Growth.

Sign up for our webinars.

Sign Up